Why square-foot expansion remains core to Lulu’s play for Athleisure supremecy

Welcome back, Vignette. It’s been difficult to escape tariff talk this week, with some of my favourite places to track the latest twists and turns being the team over at Sherwood News, who’s excellent brand of high-octane reporting has given the week’s events its appropriate level of frenzy. Some big names being talked about as being caught in the cashflow-sucking crosshairs include the star of today’s piece, Lululemon Athletica ($LULU).

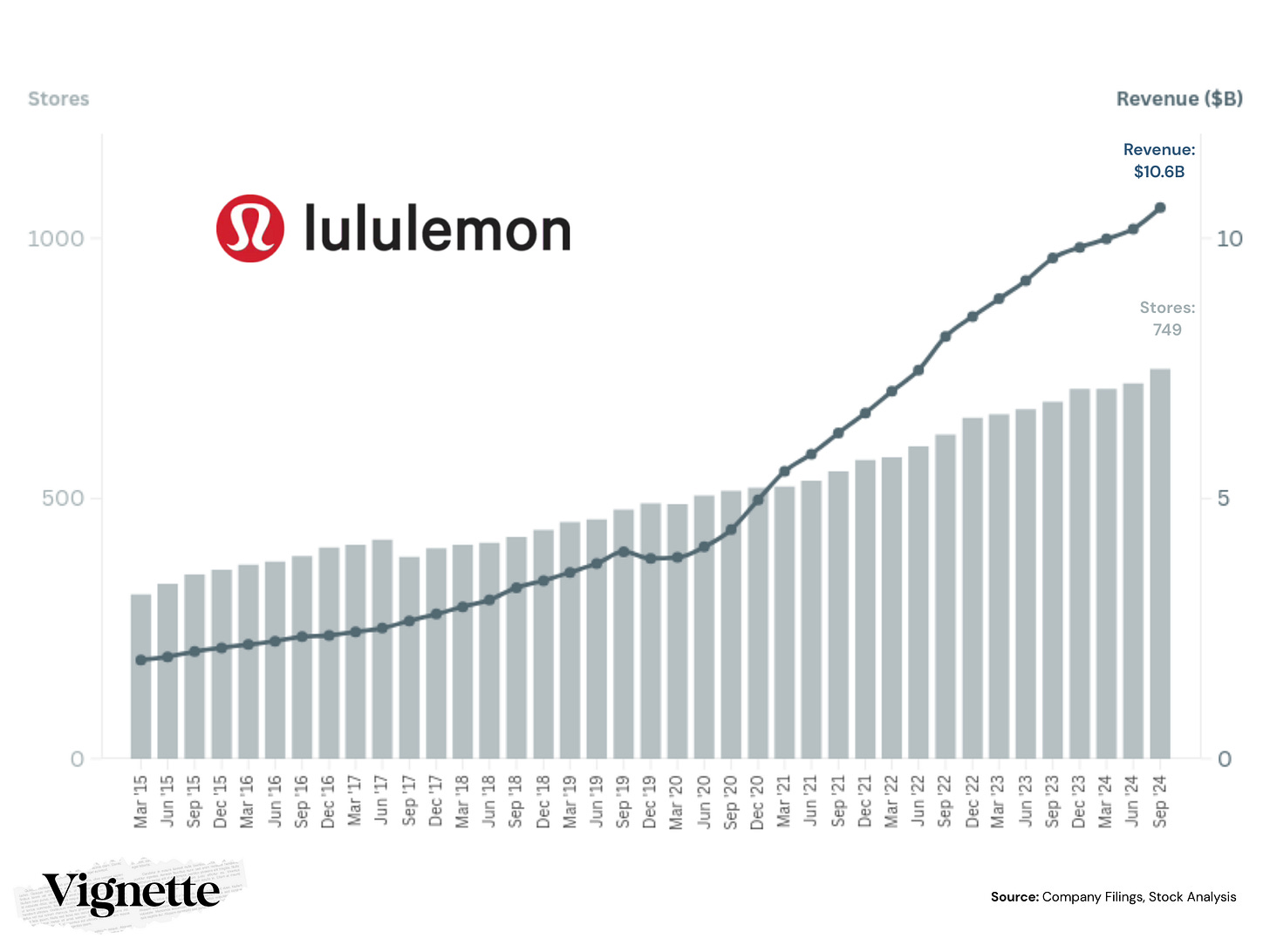

Having reported their latest earnings just a fortnight ago (now known as the “Pre-Tariff Era”), what caught my eye was how well the team were executing on their stated strategy, and that it included an acceleration of their physical store openings (40-45 net new stores planned in 2025, mostly ex-US). Despite the strong performance, the market responded coldly – dropping 16% amid consumer spending concerns. (The stock has yo-yo’d since on Vietnam tariff news. Wild times.)

Still, we control what we can control. In a world where digital-first brands are flooding social feeds with direct-to-consumer offerings, Lululemon’s physical expansion strategy deserves closer examination. So – this post looks to double-click on why the LULU exec team is making a calculated bet that:

- Physical locations drive community engagement and brand loyalty, ultimately yielding higher marketing ROI

- Store environments uniquely capitalize on new partnerships and ambassador relationships

- Community events hosted in-store—particularly those promoting their sustainability-focused ‘Like New’ program—simultaneously boost both customer acquisition and retention

Let’s stretch into this analysis.

THE STRATEGY PLAYBOOK

Clothing retail has always been a competitive landscape. Consumer tastes come and go, switching costs for consumers are low, and network effects are negligible. This then largely divides players into two camps – cost leadership or brand recognition.

Strong brands in the retail clothing space have allowed companies to;

- Command premium pricing for products that may have similar production costs

- Create customer loyalty that transcends price sensitivity

- Differentiate products in a crowded marketplace

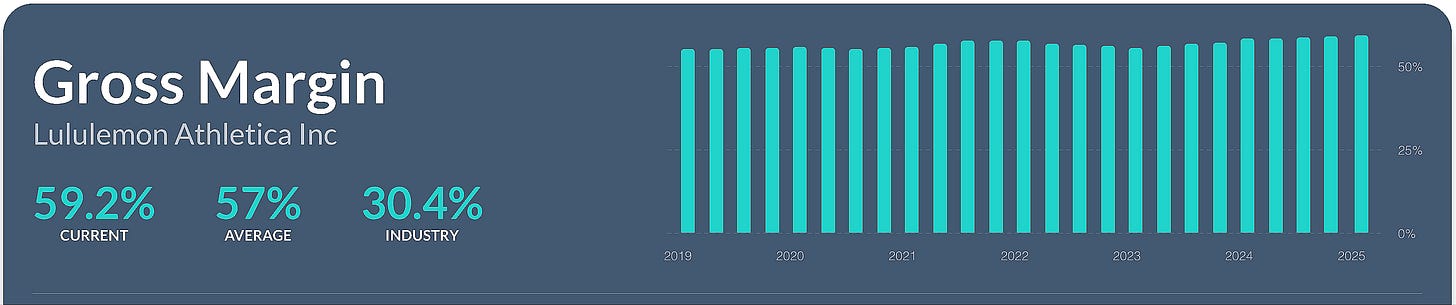

While LULU are no strangers to the odd strategic mis-step (the company is moving swiftly on from the somewhat disastrous MIRROR connected fitness hardware play), they’ve been impressive executors of brand-building across multiple global markets. Ask around, and you’ll find the Lululemon name synonymous with high-quality, stylish athletic apparel that has increasingly gone beyond the company’s traditional Yoga-focused crowd. This focus on brand awareness (tracked as a specific KPI in every market they have a presence in) has resulted in an impressive balance between growth and product differentiation, with the company maintaining a high-50s gross margin consistently, more akin to a luxury niche brand than a retail giant.

Physical stores represent far more than sales channels in Lululemon’s brand awareness strategy. As the company sees it, they function as experiential marketing hubs where consumers can meaningfully engage with products and brand values. Consistent square footage additions have proved successful so far, with company revenues displaying a 19% CAGR since the most recent strategic playbook was put in place in ‘21.

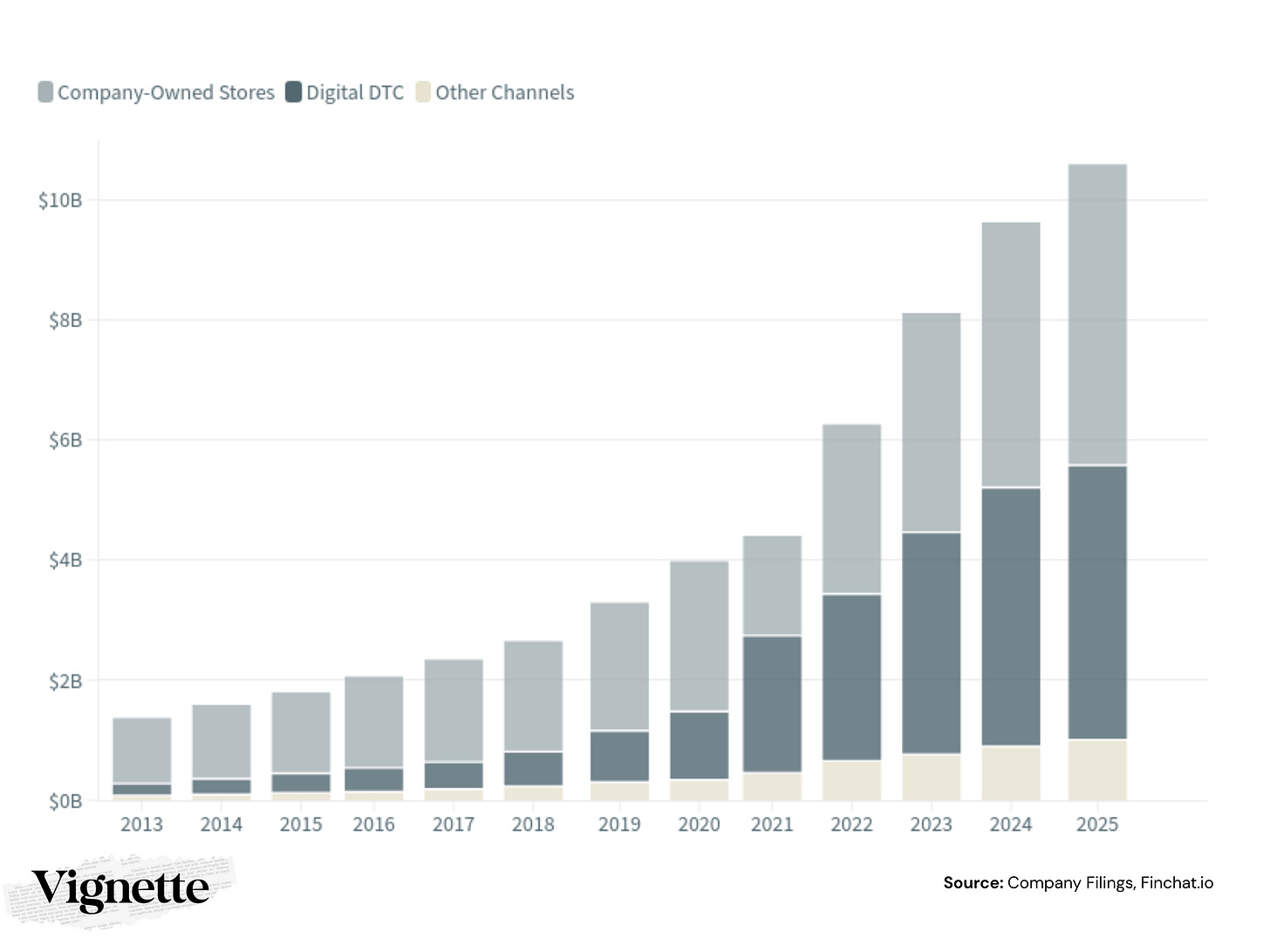

Latest year revenues are split almost equally between Operated Stores (47% Total Revenue) and Digital Direct to Consumer (43% Total Revenue), but what makes the strategy interesting is that, on the face of it – the company could easily draw the conclusion that digital growth is powering their revenue expansion in recent years, and slow down on physical store investments.

Not on your leggings. CFO Meghan Frank instead confirmed that, while the team were ahead on most of their ‘Power of Three x2’ metrics, continued square footage expansion was very much the focus;

”We expect to open 40 to 45 net new company operated stores in 2025 and complete approximately 40 optimizations. We expect overall square footage growth for approximately 10%. Our new store openings in 2025 will include approximately 10 to 15 stores in the Americas for the rest of our openings planned in our international markets, the majority of which will be in China.”

So – to our Strategy Snapshot;

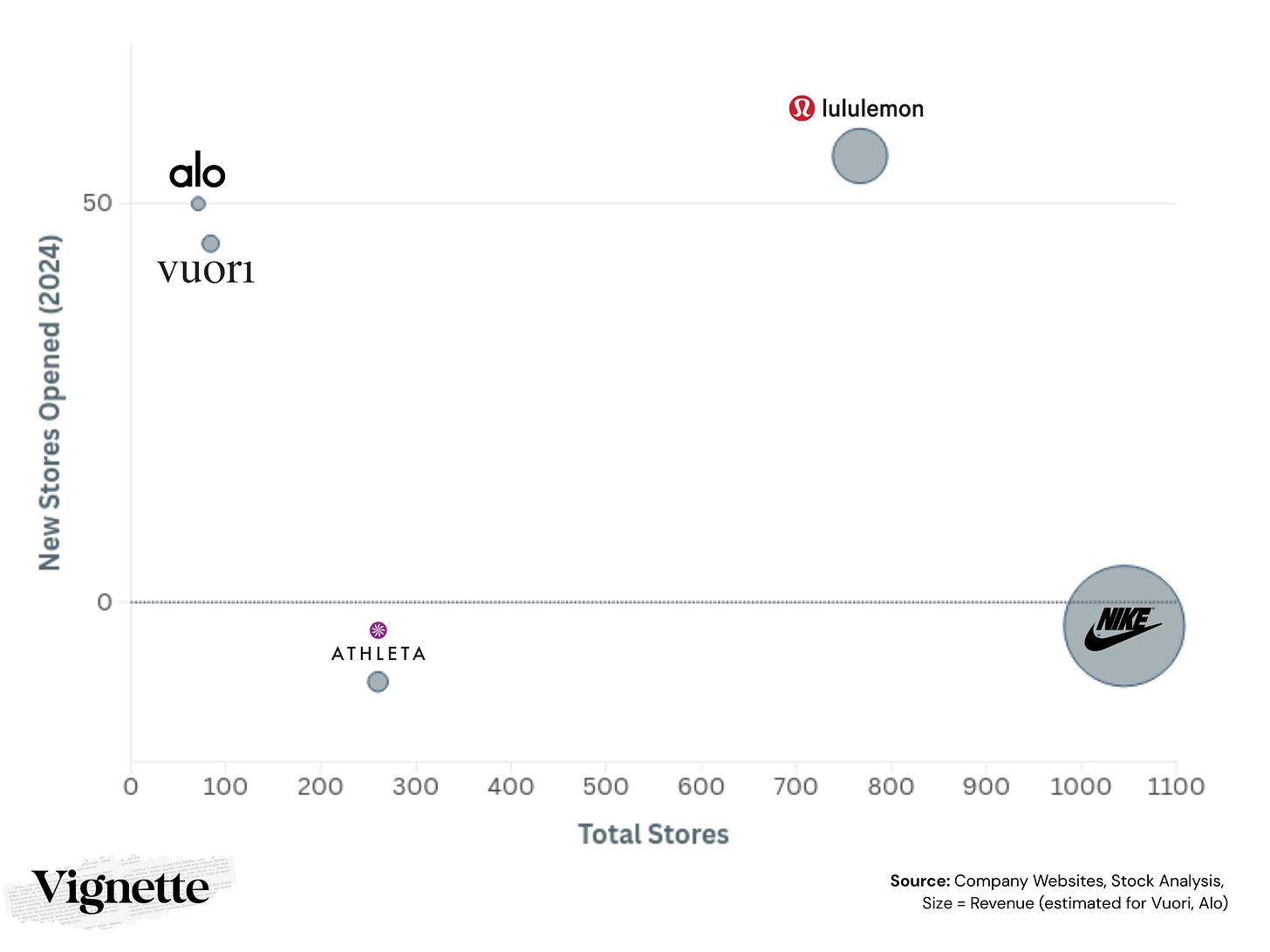

It’s interesting to see the LULU store expansion in context. Industries, and particularly very competitive ones, we know are complex adaptive systems. The company has certainly seen a rise in domestic US competition from the likes of Vuori and Alo, but as a larger incumbent in the space, Lululemon contrasts sharply to the recent physical store strategies from the likes of Nike (-3 stores last year) and Gap’s Athleta brand (-10 stores last year).

On to how Lululemon hopes to build on their physical footprint for three material strategic gains: omni-channel activation, expanding into athletic adjacencies and increased customer LTV via retention.

Leveraging The Physical Footprint: Community Activation

The company’s recent “Membership Madness” initiative exemplifies how Lululemon is trying to press their advantage in having such a physical presence. Attracting 28 million members with exclusive in-store events, free partner classes, and special experiences, the company reportedly ‘generated over 15,000 registrations for community-based sweat activations with waitlists exceeding 1,000 participants.’ Quite the buzz.

Concept spaces like the temporary “Glow Up Studio” in New York’s SoHo might well be preaching to the already-LULU-converted, but in a world where existing digital marketing strategies are being turned on their head by GenAI chatbots and search engines, as covered wonderfully by

today with his wonderfully-titled ‘Every marketing channel sucks right now’ – something tells me increasingly experiential-driven younger consumers who favour running clubs over pubs will be drawn in, with digital-first rivals finding this hard to replicate.

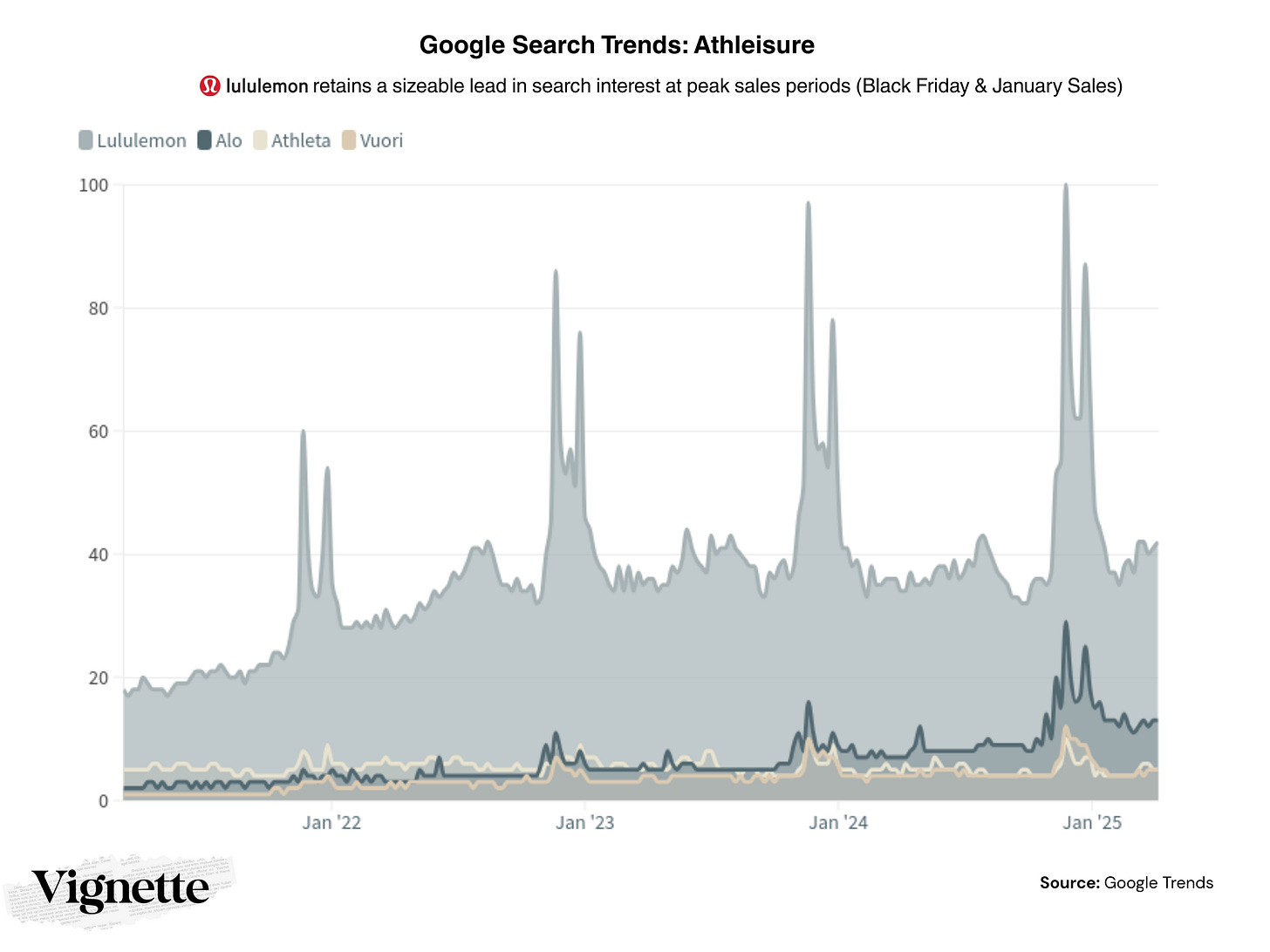

Now, to some, this may not sound like meaningful, scalable marketing spend, but its the platform that drives the omni-channel engagement. Yes – you might be more likely to pick up a new pair of sweatpants while visiting a Lululemon store for an event. But its also a platform that keeps the brand top-of-mind at critical buying times – such as annual sales seasons. Sometimes – search trend data can tell a story, and its interesting to see just how far ahead of some of the direct Athleisure challengers over the past few spurge-spending seasons.

Expanding the Fan Footprint

Also mentioned in the call was that Lululemon has elevated its ambassador program for 2025 by welcoming several high-profile athletes, including PGA golfer Max Homa, professional tennis player Francis Tiafoe, and Formula One champion Lewis Hamilton. While prior ambassadors have included influencers in the yoga community, and from across the NBA, NFL and NHL – these new partnerships, particularly with Hamilton, seem particularly savvy.

The strengthened line-up allowed for some localized, high-energy brand activations around major sporting events like the Phoenix Open Golf Tournament, Indian Wells Tennis Tournament, but partnering with Hamilton capitalizes on a growing global fan-base for the sport, and allowed for some targeted promotion around and F1 races in Melbourne and Shanghai – where the company is looking to open up some of those new stores. The company watches brand awareness survey’s closely (reportedly around the 30s in the US, but low single digits elsewhere), seeing huge opportunities to raise this in global markets with newer stores. These partnerships strategically complement Lululemon’s community-based marketing approach, generating strong social media engagement and earned media coverage that contributes to building unaided brand awareness.

Keeping Customers in the Ecosystem

To go back to where we started out, Lululemon certainly seems to have been successful in carving out a narrow economic moat, thanks to its brand management capabilities and effective operations. In doing this, it had seemed to introduce a modicum of ‘switching cost thinking’ into consumer’s heads, based on;

- The fact that product quality and fit was something LULU shoppers had come to rely on

- Community engagement that created emotional connections weren’t easily replicated

- The perception that alternative products won’t deliver the same experience

A final interesting note from the some of the recent company announcements is the focus on the company’s ‘Like New’ resale program, launched in 2022, but getting a recent emphasis. Now with a new platform partner, Archive, the combined teams were out promoting “The Like New Edit”at SXSW in Austin last year, which included;

- Free fitness classes (some with waitlists of 300 people)

- Community runs

- Curated collections of Like New clothing from four local influencers that attendees could purchase on-site.

The reason I find this interesting is how there’s an interesting aspect when combined with the expanding store footprint, and how differentiated this experience becomes than a purely transactional one.

The terms are pretty simple:

- Trade-in Process: Customers bring eligible pre-loved Lululemon items to one of 390+ participating U.S. stores for evaluation.

- Reward: Customers receive e-gift cards ranging from $5-$25 depending on the item.

- Gift Card Usage: The e-gift cards can be used both online and in Lululemon stores.

- Alternative Options: If items don’t qualify, customers can either take them back or recycle them through another partner (Debrand).

Note how much simpler this is for Lululemon to get off the ground at scale, thanks to having passed the ‘cold start problem’ with an existing large store footprint. That, to me, gives it a chance to go from ‘nice corporate responsibility effort’ to an actual scaled strategic asset for the company, with the following benefits;

- Customer Acquisition: The program attracts new customers who “skew younger and are value-based shoppers,” (said Maureen Erickson, Lululemon’s SVP of Global Guest Innovation, around the time of the program’s launch).

- Customer Retention: Keep guests in the Lululemon vertically-owned ecosystem, rather than losing them to third-party resale platforms.

- Repeat Purchase Cycle: By offering store credit for used items, it encourages customers to purchase new products, creating a continuous buying cycle.

- Market Expansion: The program makes the brand accessible to customers who can’t afford to buy $120 leggings at full price, expanding they company’s potentially addressable market.

That’s in addition to the tangible sustainability and circular economy advantages, which are meaningful for many shoppers today. As a testament to the scheme keeping buyers close, the company’s Like New website mentions that the program has kept more than 1.7 million pieces of gently-used Lululemon gear in circulation since its launch in 2022.

It could be that attachment, enabled by the company’s store expansion, is what wins out in the end – with customers being that much more incentivized to stay with the brand. As highlighted here by Earnest Analytics, 36.2% of Lululemon customers transact with the company each year since their first purchase, compared to 16.2% for rival Alo. Compound that over more global stores, and it will be an interesting watch to see how the Lululemon team continues to execute.

DATA DROPS WE’RE LOVING

- The Financial Times Visual Story on China’s Trade Surplus is masterpiece of data-driven storytelling.

- The Verge on why Color Coding is a Mathematical Nightmare sets a good tone to start the day

THIS POST’S BEATS

Hits from our Vignette April 2025 Playlist that accompanied today’s writing include soothing strings from Max Richter’s ‘Perihelion’, as well as Twin Shadow busting back with some 80s-inspired synths. Share what new releases you’ve been enjoying this month with us here!